Contents:

There certainly is depending on the candlestick you enter your trade on. Take your expected profit, divide it by the ATR, and that is typically the minimum number of minutes it will take for the price to reach the profit target. Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. According to Wilder, calculating the ATR starts from finding out the true range. More than a broker, Admirals is a financial hub, offering a wide range of financial products and services.

Any opinions, news, research, analysis and other information contained on this website are provided as mere general opinion and does not constitute investment advice. You hereby release us from any liability, loss, or damage, including loss of profit and even capital, which may arise directly or indirectly from following our general opinion. A doji is a trading session where a security’s open and close prices are virtually equal. The value of this trailing stop is that it rapidly moves upward in response to the market action. LeBeau chose the chandelier name because "just as a chandelier hangs down from the ceiling of a room, the chandelier exit hangs down from the high point or the ceiling of our trade."

The ATR declined in the first quarter of the chart shown above while prices headed north. This condition usually follows a period of high volatility as the market cools down. If low values persist for some time, the market is consolidating, and a breakout may be in order. As a rule, markets tend to range for 70% of the time, and another rule states that the longer prices are stuck in a range, the larger the breakout will be.

The formula of the average daily range used here is mentioned in the methodology section. It’s the ATR formula which is high- low in case there is no gap. Determining a static limitation for all forex pairs can be deadly to our win rate and it can turn a profitable strategy into a losing one. If there isn’t a gap, it behaves like ADR and uses the difference between high and low as its calculation.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

The https://trading-market.org/ simplifies the determination of a proper stop-loss price level such that it is not too wide nor too tight. Before we see how this can be done, we would like you to note one key principle to using the ATR. The principle is that if you go long and the price favors your position, then keep the stop loss at a value below the currency pair price that is two times the value of the ATR.

You can get more comfortable incorporating this amazing indicator into your trading strategy. Let’s say that in the beginning of march, we took this trade that is encircled. At the time of the trade, the ATR value was about 0.0080, which is the equivalent of 80 pips. Let’s say that you wanted to place a stop-loss- how much would have been that if you were using 1.5x multiplier? You need to experiement and see which vlaues work best for the instruments that you are trading. The ATR indicator can also be used to find potential breakouts.

Average True Range (ATR)

Low ATR values confirm ranging markets and buy/sell signals can be provided by Stochastics crossovers in overbought and oversold zones. By default, the ATR indicator displays a moving average of the last 14 sessions. Just like most indicators, it can be customized to include as many sessions as the trader wishes. Traders who trade short-term often use ATRs of ten sessions or fewer. The opposite could also occur if the price drops and is trading near the low of the day and the price range for the day is larger than usual.

But it can also be an important element in determining risk and establishing proper risk management. This strategy has been outlined above when discussing the uses of ATR. However, it should be recalled that a strong price movement is more reliable as it better reflects market sentiment. But I can tell you already that some of my strategies use ATR as an entry and exit criterion. If it is applied in an uptrend and there is an increase in volatility, it is possible that there will be a possible increase in panic and, therefore, a change in the direction of prices.

The difference between the current high and the current low. You can see the various locations you’d be taken out of the trade. The red line, the low, may or may not have been filled at that location.If not, you would have been taken out 1.5% higher on this chart of crude oil futures. Here are three ATR lines set at high, low, close and 2 X ATR. It’s personal preference and limited by your trading account size.

Air Liquide's ATR first low-carbon hydrogen and ammonia ... - Seeking Alpha

Air Liquide's ATR first low-carbon hydrogen and ammonia ....

Posted: Tue, 10 Jan 2023 08:00:00 GMT [source]

This brings us to the next step of the best average true range Forex strategy. Simply knowing the volatility of the last day or the last hour, doesn’t provide us with enough data to be able to make an informed decision. This is why the ATR indicator determines and plots the average of a specific number of sessions. Volatility is a term used to refer to the variation in a trading price over time. The broader the scope of the price variation, the higher the volatility is considered to be. For example, a security with sequential closing prices of 5, 20, 13, 7, and 17, is much more volatile than a similar security with sequential closing prices of 7, 9, 6, 8, and 10.

Forex Average Daily Range

At the top of the page, choose the number of weeks over which you wish to calculate pairs volatility. Notice that the longer the timeframe chosen, the lower the volatility compared to shorter more volatile periods. After the data is displayed, click on a pair to see its average daily volatility, its average hourly volatility, and a breakdown of the pair’s volatility by day of the week. Traders may choose to exit these trades by generating signals based on subtracting the value of the ATR from the close.

Trading the Gap: What are Gaps & How to Trade Them? - DailyFX

Trading the Gap: What are Gaps & How to Trade Them?.

Posted: Wed, 16 Nov 2022 08:00:00 GMT [source]

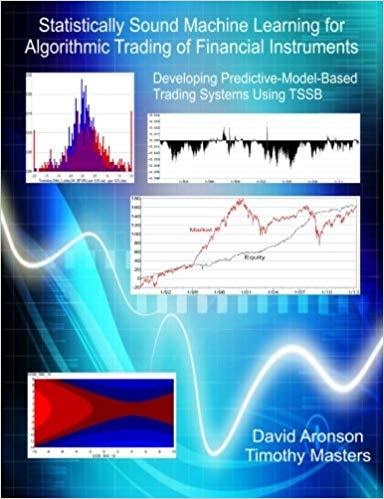

Welles Wilder’s book New Concepts in Technical Trading System. The VIX is a measure of implied volatility, based on the prices of a basket of S&P 500 Index options with 30 days to expiration. AximDaily is considered a marketing publication and does not constitute investment advice or research. Its content represents the general views of our editors and does not consider individual readers’ personal circumstances, investment experience, or current financial situation.

The ATR Advantage

These early periods are typically very volatile until the market finds its equilibrium. Key events, such as when a central bank announces changes in interest rate policy or when important economic data is released, are also to be avoided. This means if you’re a day trader, you can have a target profit of about 100 pips and there’s a good chance it’ll be hit. A mistake traders make in how to use ATR is to assume that volatility and trend go in the same direction. Welles Wilder Jr. in 1978 and is commonly used in the forex market as a measure of volatility.

The first step in calculating https://forexaggregator.com/ is to find a series of true range values for a security. The price range of an asset for a given trading day is its high minus its low. To find an asset's true range value, you first determine the three terms from the formula. It is typically derived from the 14-day simple moving average of a series of true range indicators. Here we have the “EUR/USD” currency pair plotted on a 4-Hour chart configuration. The ATR is the first indicator at the bottom of the chart, and the RSI is the second.

Securities with higher volatility are deemed riskier, as the price movement--whether up or down--is expected to be larger when compared to similar, but less volatile, securities. The volatility of a pair is measured by calculating the standard deviation of its returns. The standard deviation is a measure of how widely values are dispersed from the average value . A trailing stop-loss is a way to exit a trade if the asset price moves against you but also enables you to move the exit point if the price is moving in your favor.

- We do not make any endorsements or warranty on the accuracy or completeness of the information that is provided on this page.

- A reversal in price with an increase in ATR would indicate strength behind that move.

- Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Depending on your preferred https://forexarena.net/ frame, you’ll have to wait until the breakout candle has been developed. Then enter long once the next candle breaks above the high of the breakout candle. Trading Strategy Guides has found out through extensive research that 10 sessions or 10 periods is the perfect number to measure the volatility. As we need a beginning value for the ATR, the ATR for the first 14 periods , is simply the average of the sums of True Ranges for the first 14 periods. The actual ATR formula shown above is used on the beginning of period 15.

If you don’t use it from this point forward, you don’t belong here. There is not one stand-alone indicator that can do a great job of telling you where price is going to go. Seriously, I want this to be drilled into your head before we go any further. Most people aren’t going to like this answer because the ATR does not predict price movement, and this is “boring”. Coincidentally, you can figure out how to trade without a stop loss, assuming you need to kill its existence from trading. Check the current worth by multiplying the value at present with another multiple.